WeightWatchers, now known as WW International, Inc., is a global company that offers weight loss and weight management programs, focusing on a holistic approach to healthy living through a combination of technology, community, and expert coaching.

Once celebrated for helping millions shed pounds through its science-backed Points® system and supportive community model, the company is now making headlines for very different reasons.

Shares of WeightWatchers tumbled nearly 59% to just 18 cents in afternoon trading recently, signaling a dramatic fall from grace. The company, which peaked in popularity through the 2000s and enjoyed a high stock valuation of nearly $100 in 2018, is now facing severe financial challenges. With reports surfacing of a potential Chapter 11 bankruptcy filing, many are asking: what happened to the wellness industry’s most iconic brand?

A RISKY PIVOT INTO PRESCRIPTION MEDICATIONS-

In 2023, WW acquired Sequence, a subscription-based telehealth platform, as part of a strategic shift to stay relevant in a fast-changing industry. The sequence provided access to obesity drug prescriptions, including medications like Ozempic and Wegovy, which have recently taken the weight-loss world by storm. This move was intended to blend WeightWatchers’ behavioural and lifestyle coaching with clinical solutions, giving it a competitive edge.

However, the gamble may not have paid off as intended. Despite entering the medical weight-loss market, WW continued to face declining revenues and subscriber numbers. Analysts noted that the brand struggled to attract younger audiences, with its image perceived as dated in comparison to newer, digital-first health apps and weight-loss platforms.

MOUNTING DEBT AND INVESTOR CONCERNS-

WeightWatchers’ financial troubles didn’t appear overnight. The company has been weighed down by a staggering $1.6 billion in debt. In January, it drew down the remaining $121 million of its $175 million revolving credit facility, a move the company claimed was meant to provide “financial flexibility” rather than address immediate liquidity needs. Still, the timing suggested otherwise to many observers.

The company faces more than $1.4 billion in loans and bonds coming due in 2028 and 2029. With little room to maneuver, the pressure on WW’s finances has only intensified.

Credit ratings agency S&P Global Ratings downgraded the company in February, pointing to its aging subscriber base and declining brand relevance. WeightWatchers bankruptcies now seem more probable than ever, especially if ongoing negotiations with creditors fail.

CELEBRITY INFLUENCE: BOON AND BANE-

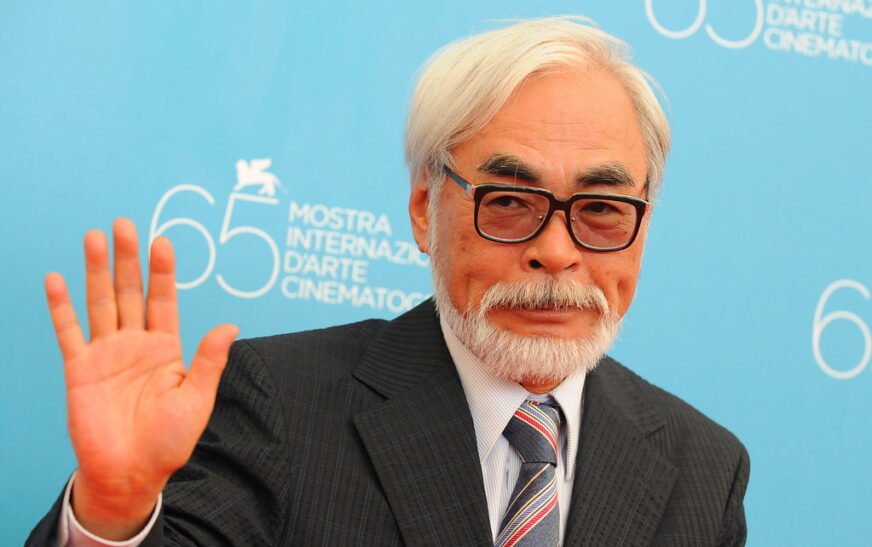

One of the company’s most prominent backers, Oprah Winfrey, became a major shareholder and board member in 2015. Her endorsement brought renewed visibility and credibility to the brand, but her recent exit has sparked concern.

The use of celebrity endorsements has long been a staple for WeightWatchers’ marketing campaigns. In 2014, singer Jessica Simpson appeared in ads highlighting her post-baby weight loss journey, a campaign that resonated with millions. However, in the current climate, celebrity-driven stories have taken a backseat to clinical solutions, shifting consumer focus away from the lifestyle-based model WeightWatchers championed for decades.

In March 2023, WeightWatchers’ shares hit an all-time low, just as Winfrey admitted to using weight-loss medication and stepped down from the board. The move was seen by many as a signal that even its most passionate advocate no longer believed in the company’s traditional model. With Oprah’s departure, the brand lost not only star power but a vital connection to mainstream consumer trust.

LEADERSHIP EXODUS AND BRAND IDENTITY CRISIS-

As financial pressures mounted, leadership turnover added to the instability. In the past year alone, both the chief executive officer and chief financial officer left the company, leaving a vacuum in strategic leadership during one of the most turbulent periods in its history.

Coupled with a brand identity crisis, WeightWatchers finds itself struggling to define its place in a crowded, evolving marketplace. Once the go-to name in weight loss, it is now seen by many as outdated, especially among Gen Z and younger millennials who favor body positivity movements and tech-driven wellness solutions.

THE ROAD AHEAD-

Reports of a planned Chapter 11 bankruptcy, first disclosed by The Wall Street Journal, underscore the seriousness of WW’s financial woes. If a deal with creditors cannot be reached, bankruptcy may become inevitable. The process could allow WeightWatchers to restructure its debt and reimagine its future, but it will likely come at the cost of investor confidence and market share.

WeightWatchers bankruptcies may also raise broader questions about the future of the commercial weight-loss industry. As consumer preferences shift towards medicalized solutions and personalized health apps, traditional programs like WW face an uphill battle.

CONCLUSION-

WeightWatchers’ fall from wellness industry leader to potential bankruptcy filer is a cautionary tale about the need for innovation, adaptability, and brand relevance in a fast-moving sector. From high debt and declining revenue to an aging customer base and a failed strategic pivot, the company’s challenges reflect deeper shifts in how people approach health and weight management.

Whether through bankruptcy restructuring or a complete reinvention, the story of Weight Watchers is far from over. But one thing is clear: the wellness giant must make bold changes to survive and thrive in this new era.